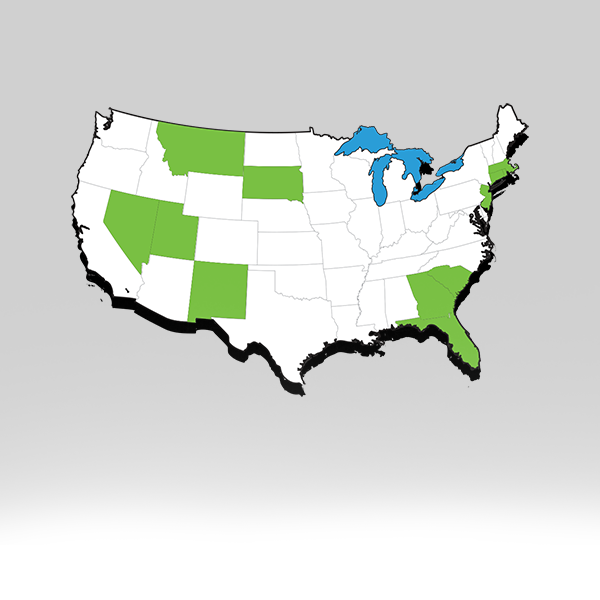

Since 2016, TypTap has taken its modernized InsurTech approach to provide quality coverage without the hassle. Success throughout Florida allowed us to plan for expansion, and in August 2020, we announced our intentions for steady growth across the United States. By the end of 2021, we proudly wrote homeowners insurance policies across our expansion states, further solidifying our plans to strategically scale our forward-thinking approach to new territories in the years ahead.

This past year brought swift growth, and significant product enhancements as our team adapted to each market. Throughout that expansion, the TypTap team worked in lockstep to support agent requests from additional policy coverage to refine our proprietary technology to meet state needs. TypTap’s Director of Sales and Marketing Expansion, Ed Spegowski, stands at the forefront of our efforts and understands the importance of a growth plan tailored to its market.

“Every state has unique needs when it comes to insurance offerings, and we’re entering every state as a carrier determined to meet those needs,” said Ed. “The quality of our policies is evident as we see a rise in organic business. We’ll continue to adapt to each area, prioritizing internal enhancements, such as additional policy coverages, technology updates, and agency support advancements.”

With each expansion, TypTap continues to introduce agents and policyholders alike to its quick, easy-to-use technologies. We’re a technology-driven insurer, but our personalized approach sets us apart. For example, every homeowner’s policy is assessed for risk individually, utilizing our long-established data aggregation and AI software to evaluate risk on an individual basis and effectively determine well-rounded policies that benefit the policyholder and the profitability of an agent’s business.

As we kick off 2022, TypTap agents and policyholders alike can prepare for a year of exciting growth. Our mission remains to simplify insurance, bring TypTap’s quality insurance products to agents across the country, and accelerate the rate of policies written and signed every week. We are committed to deepening value for current customers and extending it to future agents and policyholders.