TypTap’s mission is to use data and technology to reimagine and simplify insurance. Traditionally, homeowners policies are underwritten when an insurance company has a favorable view of a region, county, or zip code. While insurance is a necessary purchase, the typical underwriting approach of legacy insurance carriers can miss opportunities when they have geographic underwriting restrictions. We do that by underwriting down to the house level, regardless of geographic location. We can dramatically increase our total addressable market by leveraging our technology and reimagining the underwriting process. With a larger addressable market, we can drive growth while maintaining profitability.

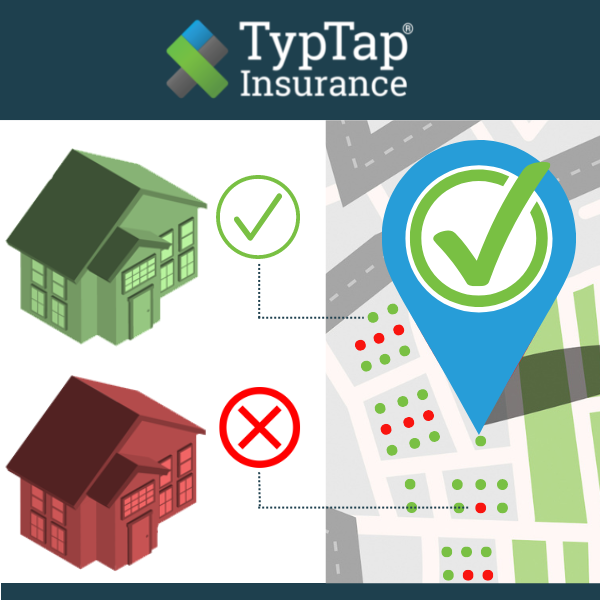

The data used to make the risk determinations may not be new, but the way TypTap analyzes the data makes us unique. In fact, the data used is readily available, like a home’s characteristics and physical attributes. At TypTap, properties are assessed at the individual house level instead of geography-based and categorized as either “green” or “red,” depending on risk determination.

Our technological advancement, data aggregation, and analysis support this approach. By leveraging Exzeo, our internal technology division, TypTap aggregates over 1,000 intelligent data points, such as year built, roof type and condition, construction type, and regional geography. From here, TypTap can draw a multidimensional conclusion of each home’s risk and projected profitability.

This individualized approach to underwriting allows TypTap to write insurance for homes that are expected to be profitable over the life of a policy. TypTap’s technology results in a loss ratio 25 points lower than the industry.

The result is a scalable, profitable underwriting platform equipped to target entire markets at a rapid pace. Green properties indicate those that meet TypTap’s return thresholds, while red properties are deemed unprofitable risks not to be bound as a policy. This differentiated strategy broadens TypTap’s reach, as homes in the same neighborhood no longer depend on the area’s zip code for coverage. TypTap’s “red vs. green” underwriting approach shifts the focus from entire neighborhoods to the rooftop level with precise risk selection and reduced claims rates.