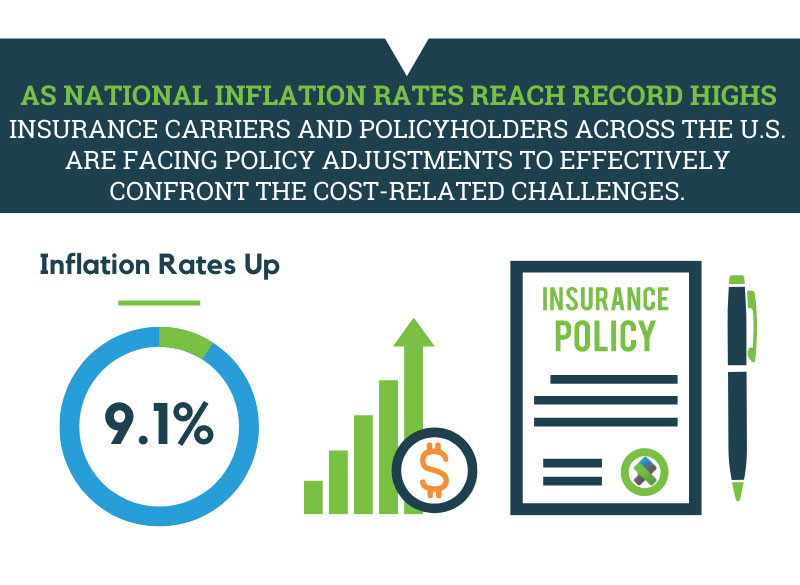

As national inflation rates reach record highs at 9.1 percent, insurance carriers and policyholders across the U.S. are facing policy adjustments to confront the cost-related challenges effectively. Amid these economic obstacles, the insurance industry must consider its primary purpose – ensuring policyholders always have adequate coverage to rebuild their homes if the unthinkable happens. For TypTap, the decision to proactively adjust policy limits was strategically enacted as a diligence measure to manage coverage limits for policyholder peace of mind in an inflationary environment.

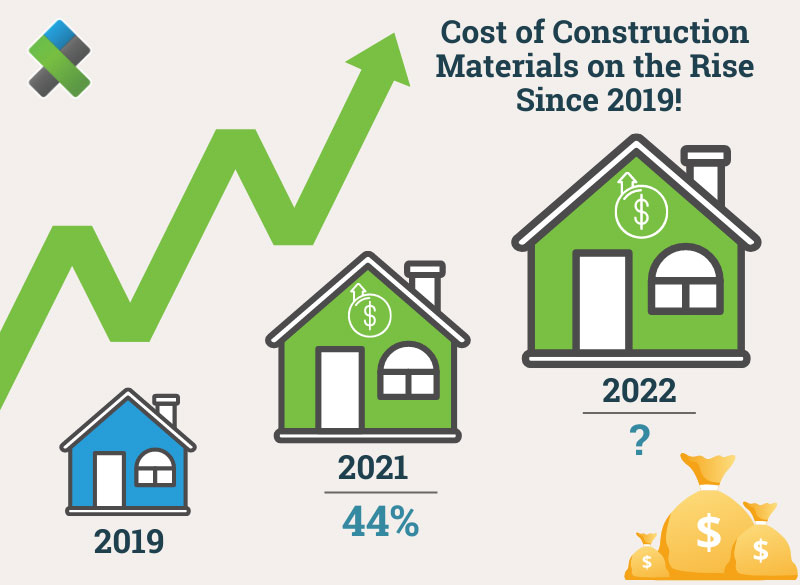

Homeowner insurance policies are built with standard replacement cost provisions that establish sufficient coverage to rebuild a home in the event of a claim. Recently, home construction costs have been compounded by supply chain disruptions, labor shortages, and high demand for repair materials. These cost-related constraints contribute to the severity of losses on homeowners’ insurance claims, leading to higher loss ratios for insurance companies. Today’s costs for home repairs are vastly different than the prices five years ago, and insurance rates must reflect current expenses to ensure the long-term stability of insurance carriers. For example, the price of construction materials rose by 44 percent since 2019, heightening today’s costs for home renovations and overall claims expense. Ultimately, inflation and claims expenses increase premium adjustment for policyholders.

TypTap’s technology-driven underwriting process helps reduce the impact felt by policyholders; however, policy premiums must still align with inflating costs. An adjusted premium prepares and protects homeowners against claims inflation to certify an insurance policy effectively delivers full restoration. At TypTap, our policies are built with security and stability at their core. These key principles guided our strategic decision to monitor premiums in response to market conditions for the long-term benefit of the policyholder.

Our diligent approach to insurance requires consistent evaluation and adaptation. We will continue to prioritize quality coverage backed by technological innovation, keeping our commitment to security and stability despite the current inflation trends.

U.S. Bureau of Labor and Statistics – Data reported July 13, 2022