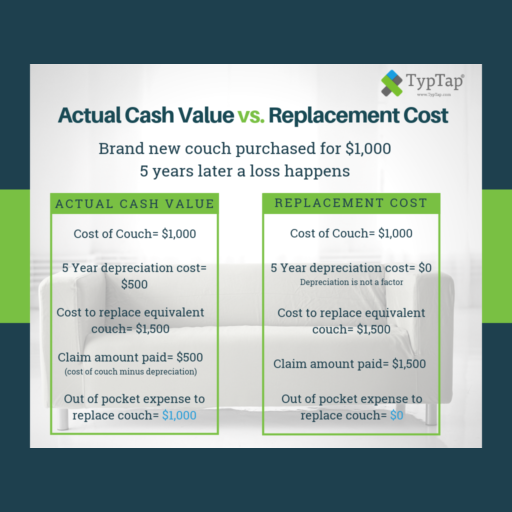

The main reason we, as consumers, obtain insurance policies is to provide protection in the event of a loss. It offers peace of mind knowing that if we have damage to our homes we will, in most cases, be reimbursed for those damages. Some carriers, like the National Flood Insurance Program (NFIP), don’t offer full protection because they take depreciation into consideration. This type of coverage is known as Actual Cash Value. At TypTap, we believe coverage matters. This is why we offer Replacement Cost not only for secondary homes but also on personal property. Let’s break down the differences between Actual Cash Value vs. Replacement Cost.

Actual Cash Value (ACV) simply means the actual value of the item that has been damaged. This item could be the home or the contents within the home. For example, if a roof of a home is damaged that is 10 years old, the actual value of the roof is the cost of the roof minus the 10 years of depreciation. It’s like buying a brand-new car and trading it in 10 years down the line. The car is not worth as much as it was 10 years prior, so you only receive a small amount of money for it.

Replacement Cost (RC) means the cost it would take to replace the item today. For example- you buy a new 50’’ flat-screen television that costs $800 when 3 years later your home floods and the tv is a total loss. Three years have gone by and this tv now costs $1,000 brand new. Having Replacement Cost coverage on your policy would mean you would receive the $1,000 for the damaged tv because that is the cost it would be to replace it with the same or similar item.

This information is important to know so policyholders can fully understand how their policy will respond in the event of a claim. TypTap includes Replacement Cost coverage for the building in all our policies for both primary and non-primary homes. As an option, policyholders can choose to add Replacement Cost on contents to better protect themselves, which is not offered by the NFIP. This is just one more reason you’re better protected with TypTap!